Hey Friends🖐️,

What if I told you there was a hardware startup that achieved what Facebook and Amazon couldn’t? Today we’ll analyze how Nothing, a consumer electronics startup out of London, built a successful smartphone business.

I usually provide templates for holistically making physical products. We’ve talked about how to create requirements docs, financial models, delightful experiences, and more.

But over the past few months on Substack I’ve really enjoyed reading case studies from Lenny and Aakash about the growth stories of successful software businesses (Notion, Duolingo, more). In this new format, I’m going to attempt to do the same for hardware businesses. In today’s article we’ll be covering Nothing’s story around thier:

Financials

Founder’s Bio

Company Journey

Growth Levers

Mistakes

Among the Fastest to $1B

I’ve selected Nothing as the first company in this series because, having been in consumer electronics, I can sympathize with the challenges of navigating manufacturing technologies, low margins, saturated markets, opinionated users, and unforgiving design constraints. After automotive, I believe it’s one of the riskiest industries to start a venture in.

Despite this Nothing has achieved a milestone that 0.1% - 0.3% of consumer hardware companies ever do, reaching a billion in lifetime sales.

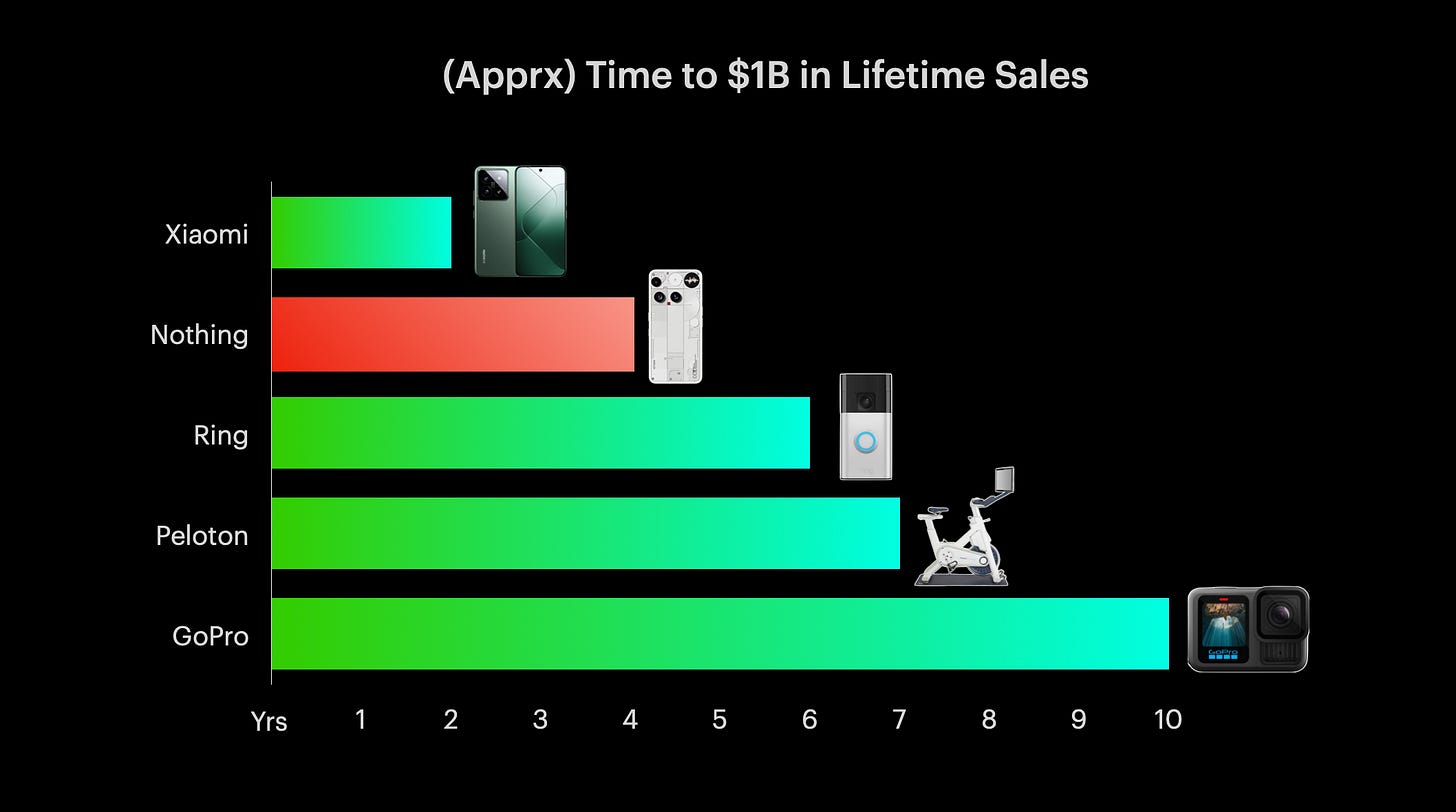

On top of that, they’ve hit the milestone faster than most other HW startups in the last 20 years. It took Nothing approximately 4 years versus Ring, Peloton, and GoPro, which took between 6-10 years to accomplish the feat. Nothing trails only Xiaomi which took 2 years, probably due to the massive scale of Asian markets.

Product Market Fit (PMF)

While there isn’t a universal definition for PMF, it can be implied by a combination of variables. In general it’s a mix of positive feedback, predictable growth, stable retention, and strong loyalty.

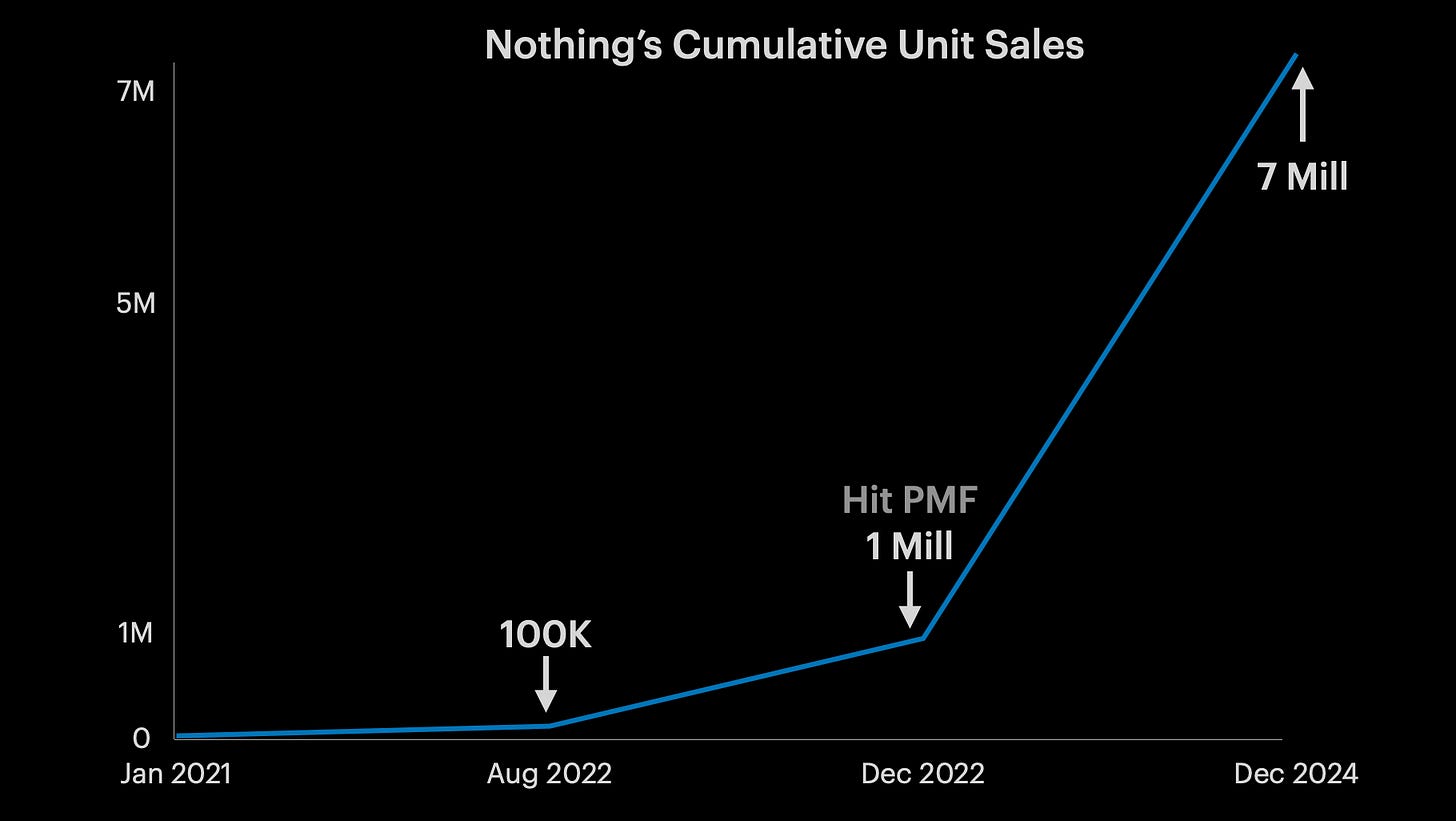

For smartphone companies, let us use one million units of lifetime sales as a directional indicator. While this isn’t a definitive metric, it demonstrates sustainable demand and a significant enough volume to offset component costs with manufacturers.

Nothing has achieved this milestone in 2 years (phones plus audio). It then followed with rapid growth to 7 million units by the end of 2024.

🤔Interested in learning 0-1 HW Product Management?

Our readers have been requesting a practical guide to taking a hardware idea from concept to mass market.

We’ll be covering principles including HW product sense, business feasibility, go to market planning, user desirability, and technical viability.

Our goal is to help beginners or even experienced product makers sharpen their craft. Drop your email below for access to initial modules and early bird pricing.

1. The Founder

We can’t start a deep dive without first understanding Carl Pei’s founder journey.

He was born in Beijing and raised in Sweden. Carl recounts being a technology enthusiast even in childhood since he was one of the first iPod and iPhone users in his country. Later he dropped out of the Stockholm School of Economics in 2011 to work at Nokia, Meizu, and then Oppo. At Oppo he led international expansion and introduced online first marketing, selling Chinese smartphones to global markets.

In 2013 at 24 years old, Pei and former Oppo VP Pete Lau teamed up to create OnePlus. He helped OnePlus become a household name, selling 1M units of their first phone, thanks in part to an invite only marketing strategy.

Although it’s not confirmed why he left OnePlus, some reports indicate the company’s culture started drifting from a scrappy startup ethos. Pei valued creative freedom, and in parallel, he noticed that consumer technology was stagnating. It was emotionally disconnected and lacked personality. There was no design or community driven approach. He wanted devices to feel fun again, and with that, Nothing was founded.

Nothing’s Story

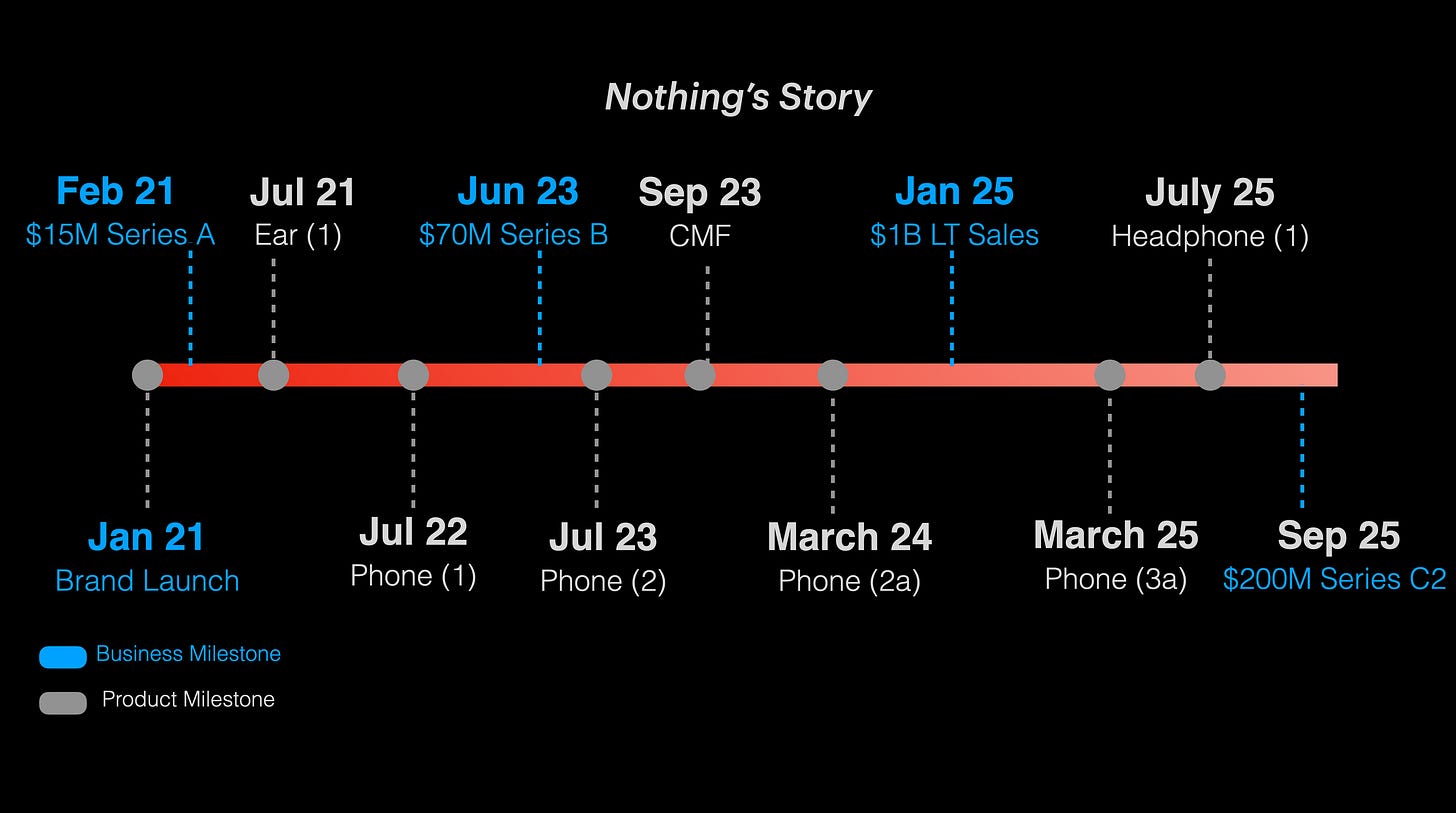

Nothing was co-founded in stealth mode in late 2024 with $7M in seed funding, but the brand was officially launched in 2021. The Ear (1) wireless earbuds were Nothing’s debut product in July 2021. Their unique, transparent design and attractive price point immediately made them a fan favorite.

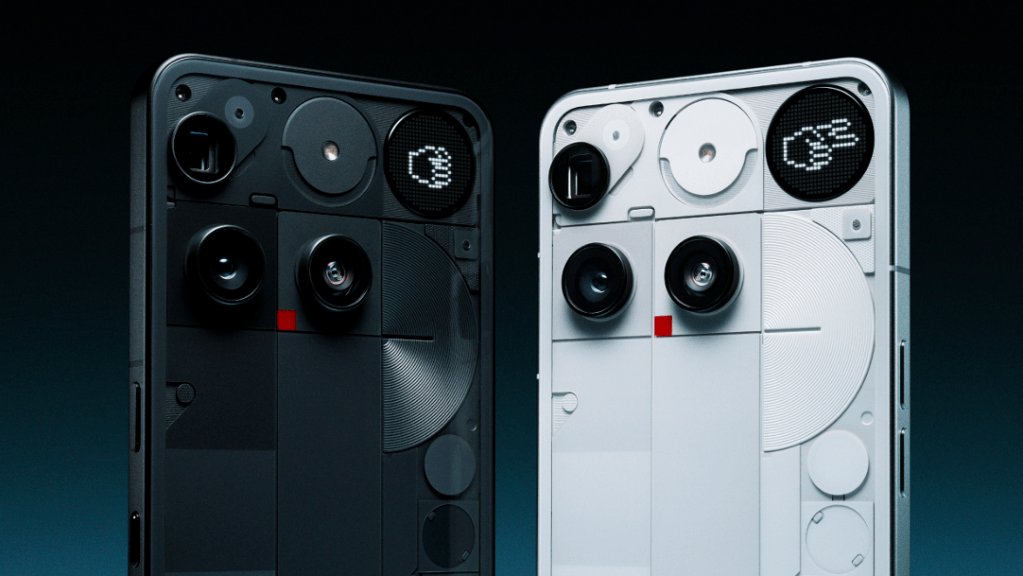

Then in 2022, Nothing launched their first smartphone, the Phone (1). This phone introduced Nothing’s signature glyph Interface and developed an almost cult like following. It was celebrated in the enthusiast space as a breath of fresh air and a device with actual utility at its price point.

Nothing secured a $70M series B round in 2023 and released the Phone (2). This helped move the brand further into the mid range segment with a powerful processor and refined industrial design.

In September, Nothing launched a sub-brand, CMF, to cater to budget focused users who still wanted value at entry level price points. This also helped them expand supply chain partnerships and mitigate operational risks.

The Nothing Phone 2a launched in March of 2024 and became one of their top selling devices. Building on this momentum, the company hit $1B in lifetime sales in December of 2024.

In 2025, Nothing faced controversy after launching its first Flagship, the Nothing Phone (3). Customers were frustrated that Nothing charged premium pricing for mid tier components (chips, displays, etc). We’ll cover this in more detail below.

From a funding PoV Nothing closed its latest series C2 round at $200M in September of last year. In 2026 there’s interest to see how Nothing will address the challenges of a growing but very particular user base, along with AI centric use cases.

Product Strategy Differentiators

I’ve been trying to understand which growth levers enabled Nothing to scale so rapidly and have come up with the following list.

1. Lower Risk Entry HW

Nothing’s first product wasn’t a phone. It was a pair of earbuds. This could be for a couple of reasons.

Nothing estimated that they would need to raise at least $100M to make a successful smartphone brand. This cost prohibition made it unfeasible to pursue the mobile phone space as a new entrant.

It was challenging to develop factory relationships and trust. Contract Manufacturers like Foxconn had lost significant capital in working with HW start-ups who failed to deliver on sales projections, leaving the CMs stuck with unsold inventory. This made suppliers increasingly skeptical of new players.

This is where earbuds came in. This product category would let them validate demand for their brand, creating a stronger financial portfolio when talking with investors or partners.

Earbuds also helped showcase their design and engineering capabilities. Audio products possess several hardware and software components that are adjacently used in phones, but at a slightly lower level of sophistication.

Most importantly, it would help them sell mass production level volumes and build trust with suppliers who would be willing to work with them later for larger programs, such as smartphones.

This seems like a good, general approach for hardware startups. A lot of times we want to make the first product a hero product, but fail to realize that several funding and supply chain constraints would make such endeavors unfeasible. Instead, it’s better to validate product market fit and use earnings to invest in future, more sophisticated devices.

2. Design as DNA

In a sea of sameness, competing on raw specs or technology against giants like Apple or Samsung is an unlikely battle that any startup would win. For this reason, Nothing uses design as a business strategy. It makes them stand out. Their design themes include nostalgia, transparency, and unique industrial forms. They draw on retro aesthetics and transparency, which reveals a sense of honesty by showing internal components. They synthesize a good mix of familiar and futuristic materials, shapes, and finishes.

However, there are many reviews criticizing misaligned cameras, lines, and textures. Maybe this is intentional, and it’s to appeal to their niche demographic, known for being creative, sometimes rebellious users who are frustrated with the homogeneous nature of the current tech scene. Either way, their fresh approach to design has worked.

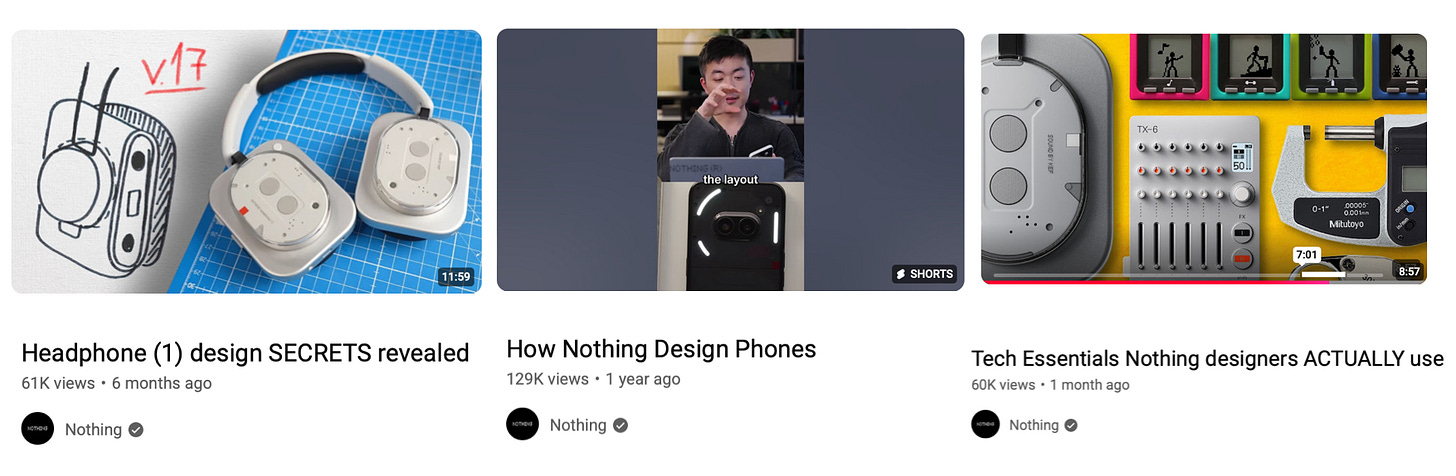

I have also noticed how upfront they are with design as a part of their company’s culture. Just scrolling through Nothing’s YouTube channel, one comes across a series of videos going behind the scenes of their ideation process.

Their designers are public and are not afraid to talk about why a particular material was chosen, what the prototyping tools were, how the test fixtures functioned, and more. As a fan of industrial design and documenting the build process, I wish more companies would do this.

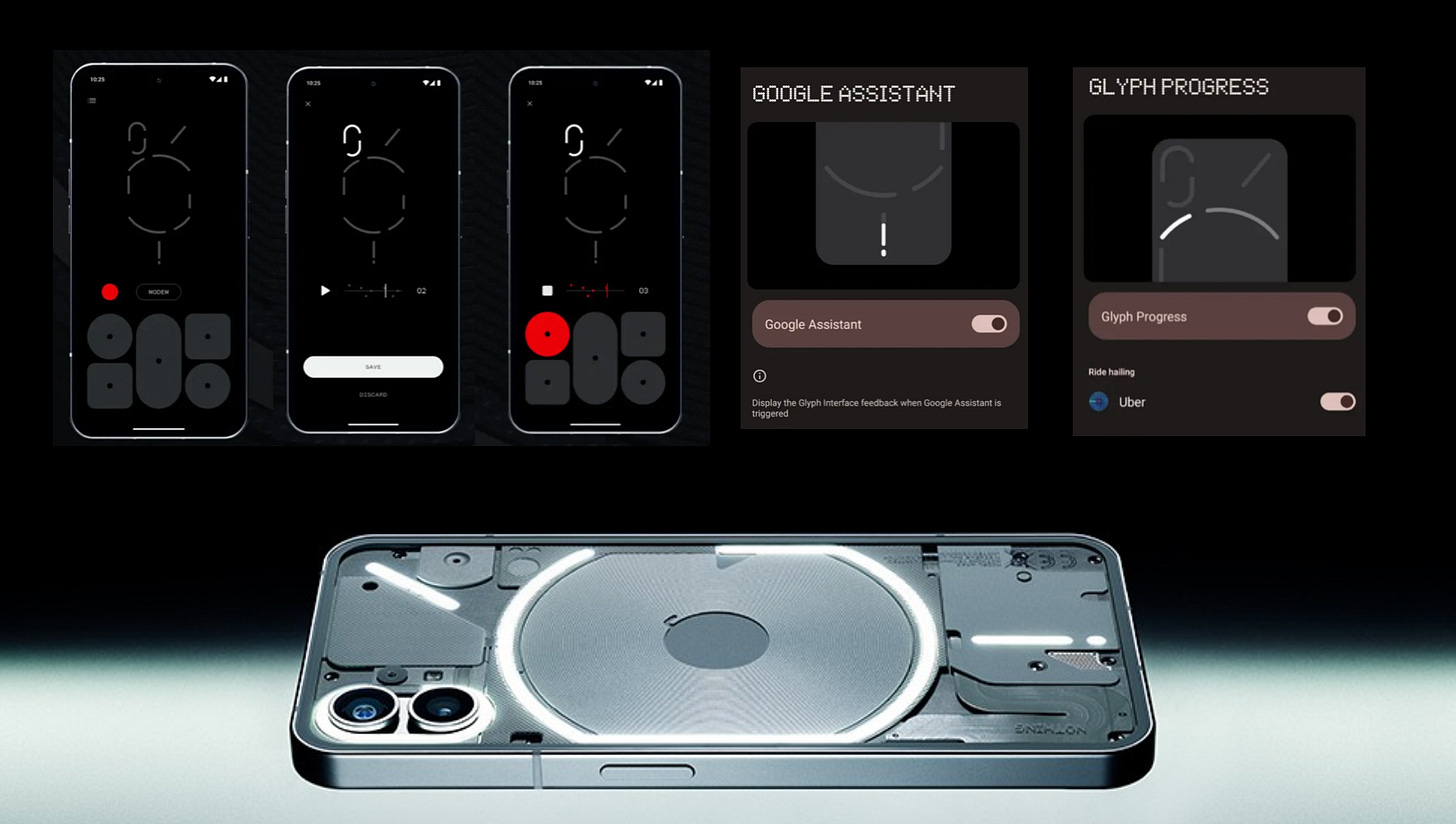

An example of using design not just for aesthetics and marketing, but also for functional problem solving is their glyph interface. People spend too much time on their screens. Nothing’s approach to solve this was to design a set of LEDs on the back of the phone that provide customizable notifications and interactive elements. You can use the glyphs as a battery status indicator, timer, calling aid, and more without turning on your screen.

3. Building for the Gap

Companies like Apple and Samsung invest their top resources in the premium phone range, leaving the mid and entry range phones neglected in a sense. The landscape is largely split between functional mid range devices, uninspiring entry range devices, and expensive flagships. This naturally creates a gap in the middle, where users want a better experience but are okay with some tradeoffs.

Nothing saw this market gap and succeeded by offering compelling design, quality materials, symmetrical bezels, and a clean software experience instead of the bloatware on most mid tier phones’ operating systems.

4. Users

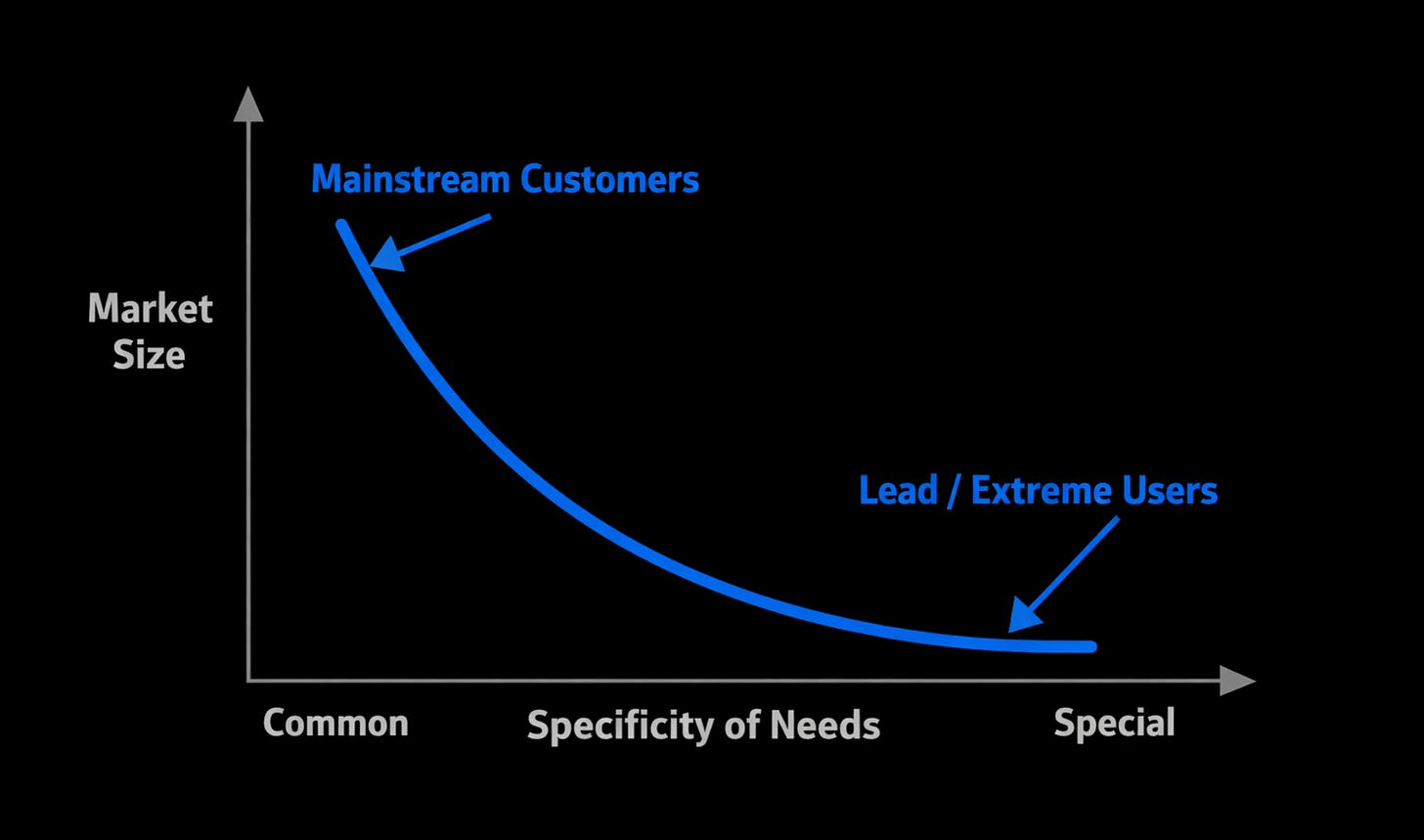

As a quick refresher, there are generally two types of users. Mainstream users have needs that are well met by existing products and are satisfied with established designs. While they can help us understand the must have features for a product, catering to their needs isn’t the best way to establish a disruptive device. This is because they typically ask for “faster, cheaper, easer” versions of existing products.

Lead users on the other hand struggle with needs that will become more apparent in the future. They’re typically enthusiasts who sometimes hack and build their own solutions. For a startup, they are helpful because their needs can foreshadow the general market and they can help cut development time by implementing their workarounds. The risk is that they are very picky and can over constrain a product. More on that later.

For Nothing’s core series of products, the majority of their customers appear to be lead users. They are younger creatives (average user is 26 years old in contrast to Samsung’s average age of 45) who are value and identity-conscious tech enthusiasts. These lead users cultivated a community approach where close to 8,000 fans invested $8M in the company. They also helped design aspects of Nothing’s hardware and software through public ideation sessions.

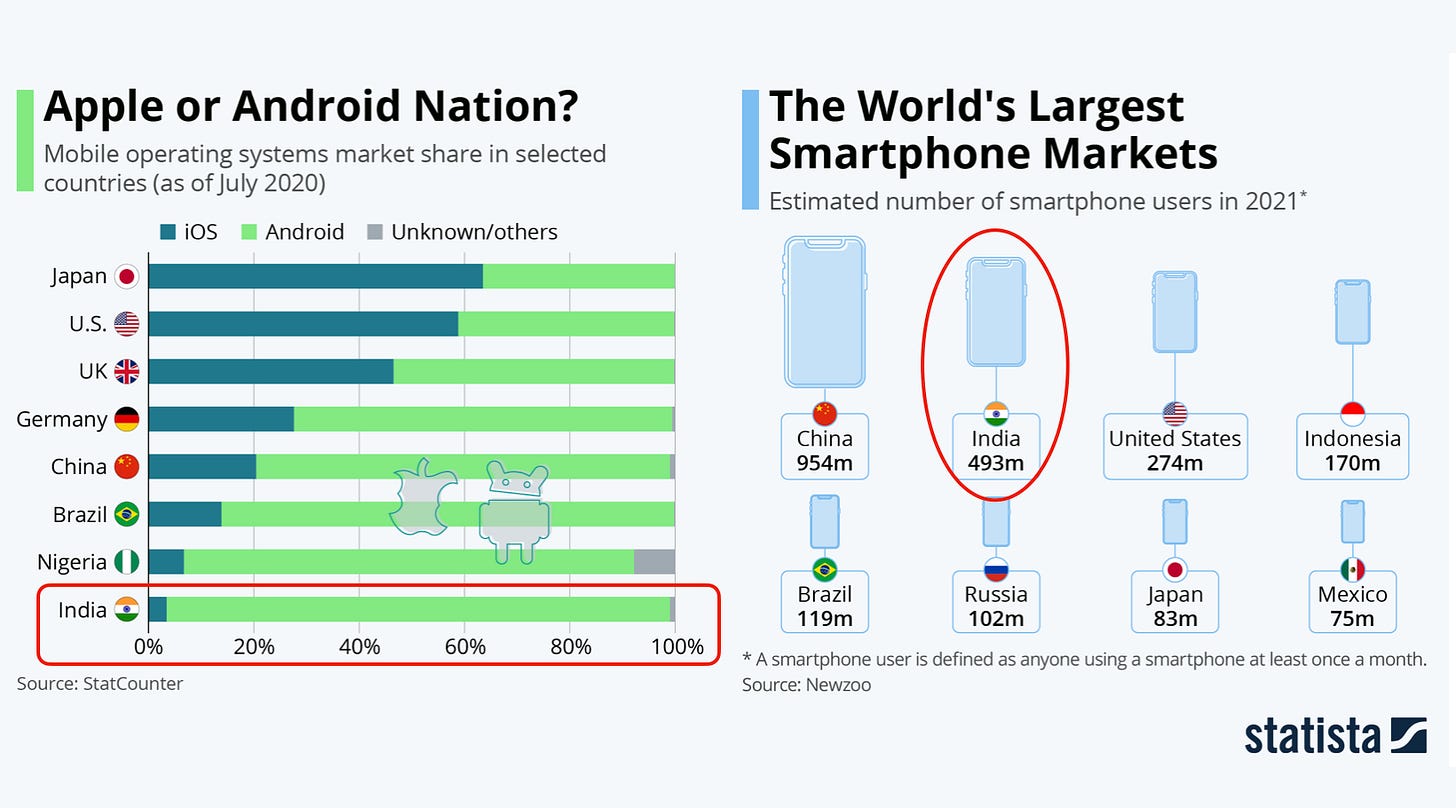

For their mass market brand CMF, Nothing is focusing on the Indian user base to help drive volume and scale. In 2020 over ~90% of smartphones in India were Android compared to ~40% in the US. Given that it’s easier to convert an Android user, and that India has the second largest smartphone users in the world, this is a great growth opportunity for Nothing. According to Carl Pei, the energy in India feels similar to China in 2011 given that there’s a growing economy and an emerging middle class.

Designing products to be more appealing for larger markets outside of the US is a winning strategy, not just for startups. Even Apple reported a record breaking fiscal Q4 2026, with iPhone revenue soaring 23% YoY (one of the best quarters ever). The main driver? Tailoring the iPhone 17 base model for the Chinese market with more attractive features.

5. Founder Led Marketing

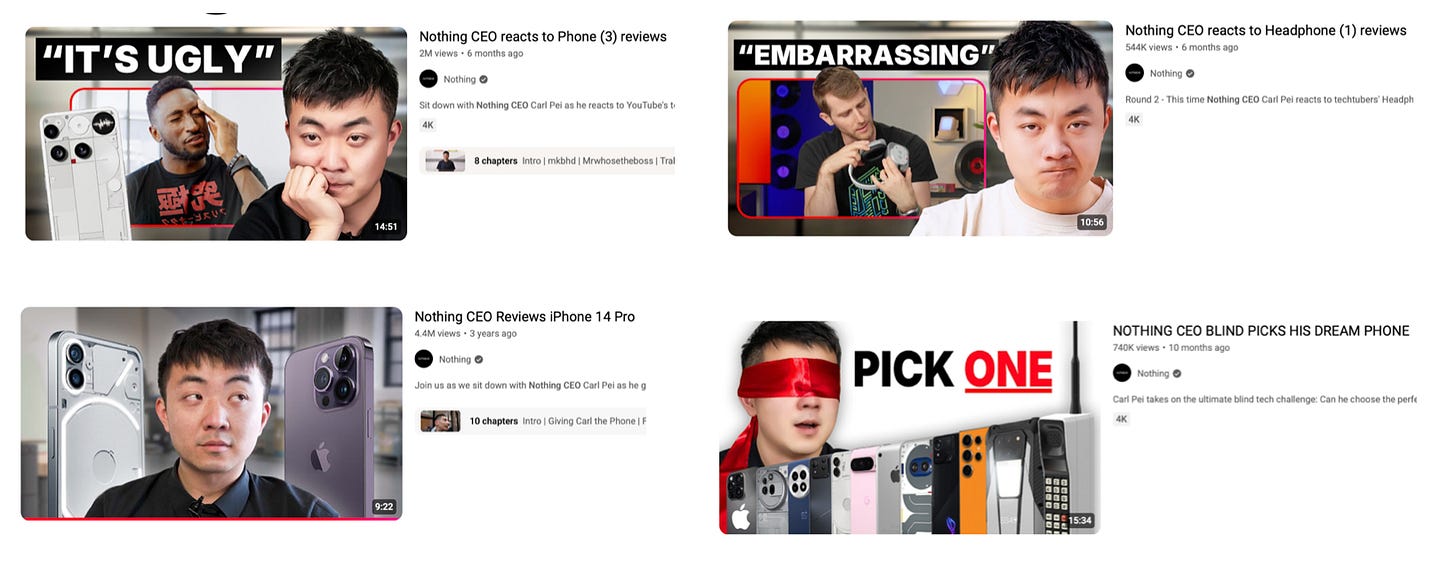

Nothing clearly doesn’t have the same marketing budget as its established competitors, yet their phone reviews and videos are always at the top of my socials. But maybe my algorithm is just biased. Aside from the obvious startup marketing strategies like community based referrals and focusing on emotions instead of specs, I wanted to touch on their founder led branding.

Carl Pei is everywhere online. You can find him on several podcasts breaking down exactly why a feature was picked, the constraints they were working with, behind the scenes narratives, and providing his personal takes on famous products.

He also does reaction videos to popular tech YouTubers who review Nothing devices. This almost brings a sense of authenticity, which helps with organic marketing and community building. I say almost, because not all user complaints are always addressed by him. Regardless, the ability to provide his takes, just as if he were one of us is refreshing.

6. Partnerships

Nothing has partnered with several well known names. From Audio with KEF, to creative imaging with Jordan Hemingway, to repairability with iFixit, to investment and publicity from Tony Fadell (iPod, Nest inventor). Two of the other partnerships I thought were interesting are with Teenage Engineering and Optimeus Infracom.

Teenage Engineering (TE)

One of Nothing’s founding partners was Teenage Engineering. They’re a Swedish design firm known for unique, aesthetically pleasing audio products. They have a cult like following and have an iconic design language. Their products have been pretty popular, like the OP-1 and pocket operators.

This partnership helped establish Nothing’s distinctive design language. Many of the tenets we talked about earlier, such as transparency and playful visuals were co-developed with TE, giving Nothing a competitive advantage and cultural credibility as a new brand.

Optiemus Infracom (OI)

OI is an Indian consumer electronics manufacturer with expertise in supply chain and assembly. Nothing formed a $100M joint venture in late 2025 to establish India as a global hub for production and consumer electronics R&D. In return, Nothing receives tools to scale in its largest market such as factory infrastructure, skilled production teams, advantageous production costs, and faster market feedback.

Mistakes

Overpromising and Underdelivering

Nothing set a high bar for their Flagship, the Phone (3). Fans were expecting a compelling device with great features at a bargain price. But what actually happened was that Nothing charged flagship prices for what doesn’t appear to be a premium phone under the hood.

It features a mid range chip (Snapdragon 8S Gen 4) which, while good, isn’t up to par with phones in the $800+ range. Similarly on the mechanicals, they implemented Gorilla Glass 7i, instead of the more durable Gorilla Glass Victus series. On the camera side, it has lower sharpness and overall quality than its competitors. Its display has worse power efficiency than true flagships such as the iPhone or Pixel.

All of these factors severely erode customer trust. Nothing has addressed the criticism, citing that they’ve cut back on using expensive components to invest more effort in design and experience. Carl Pei has referenced the constraints of being a startup, stating that they don’t have the volumes to compete with Samsung or Apple for component pricing. Which is fair, but to users that doesn’t matter.

Customers don’t care about a company’s financial concerns. To users, the most important thing is a reliable, trustworthy experience. In the words of Tony Fadell:

“Customers don’t care about what the product does. They care about what it does for them.”

Inconsistent Design and Identity

As we discussed above, Nothing’s glyph interface was a big hit. They created a unique brand identity and provided utility. But the Phone 3 moved away from that familiar layout to a more minimal, dot styled matrix. Users say that it feels gimmicky. Glyph features like games, toys, and a grainy camera viewfinder don’t really provide much value.

Going Down a Slippery Slope

For all the great things Carl Pei has done, Nothing could be following a parallel path to his previous company, OnePlus. Similar to Nothing, One Plus was an enthusiast centered phone brand. However their fanbase has turned against them citing cost-cutting measures, increased pricing, and chasing mainstream features without the quality.

To avoid this trap Nothing seems to be leaning into a more intentional strategy for 2026 by skipping their flagship launch and focusing on other products. These may include initiatives such as AI native experiences and combating component pricing surges.

Ultimately, Nothing’s success will depend on whether they can convince their fanbase that they haven’t diverted from their unique identity. They will have to make some difficult decisions as the brand matures from niche to mainstream.

Takeways

Here’s a summary of what we learned from Nothing’s journey:

Low Risk V1 HW: Nothing used earbuds to build manufacturing trust and validate brand demand before tackling the smartphone market.

Design as a Moat: Nothing uses industrial design as a core business strategy to attract lead users who are dissatisfied with the industry’s stagnation.

Key Partnerships: The cultural credibility of Teenage Engineering allowed Nothing to grow faster and create a loyal fanbase.

Founder Marketing: Carl Pei’s public facing style creates an organic community sentiment and a level of transparency.

Uncertain Future: Nothing needs to act fast to maintain its identity during a period of negative user sentiments and rising global component costs.

That’s all for now. What company should we cover next?

Thanks for reading

Make sure you check out some other articles:

Excellent breakdown. The earbuds-first approach is seriously underrated asa hardware strategy. Starting with lower risk products to validate demand and build supplier relationships is smart, especialy in consumer electronics where component pricing can make or break margins. I've seen too many startups try to launch flagship devices first only to get crushed by supply chain complexities and funding realities.

Great Article @Building Hardware!

Nothing came out the gate with a Design Feature, the glif, that grabbed attention, and their trajectory has been all positive until the Phone(3). Departing from the glif and skimping on specs has hurt the product.

Their next product is going to be super important for Nothing. London is still one of the best places in the world for Industrial Design, and I am sure they will be exploring options to captivate their fans attention once again!