🤖Guide to Manufacturing & Supplier Selection

Sourcing and developing contract manufactures to take ideas from concept to reality.

Hey Friends 🖐️,

Imagine being in China during covid lockdowns. You’re in a room for several days and aren’t allowed to open the window. Your only contact with people is when someone in a hazmat suit knocks on your door for temperature checks. Also imagine taking kidnapping training prior to visiting a dangerous part of Mexico.

Well I’ve been in both of those situations and hope you don’t have to go through the same to learn about developing suppliers. Over the years I’ve worked with manufacturing partners in Europe, Asia, and the Americas. I recognize that there aren’t many resources for learning about how to source factories to make a product go from prototype to mass production.

In today’s post I’m going to try to distill almost a decade of experience in working with automotive, aerospace, consumer electronics, and energy product manufacturers.

We’ll be covering:

Key terms in Supply Chain

Low Cost Country Souring

Contract Manufacturing Assessments

RFQs

Factory visits

Supplier Selection and Development

What’s a Supply Chain?

Before we dive into contract manufacturing let’s step back and understand the bigger picture. Every physical product we use has a supply chain.

Think of supply chains as a giant network of people, services, organizations, and materials which transform raw materials into a finished product.

As users and even creators, sometimes we take the size and complexity of these for granted. I like to give some examples from automotive and consumer electronics given that we use these products regularly.

There are thousands of parts in cars which are globally shipped from suppliers, and sub suppliers, that converge at a final assembly line. For instance, the airbags may come from Autoliv in Utah, body panels from Kirchoff in Ontario, glass from Fuyao in China, control systems from Bosch in Germany, and so on.

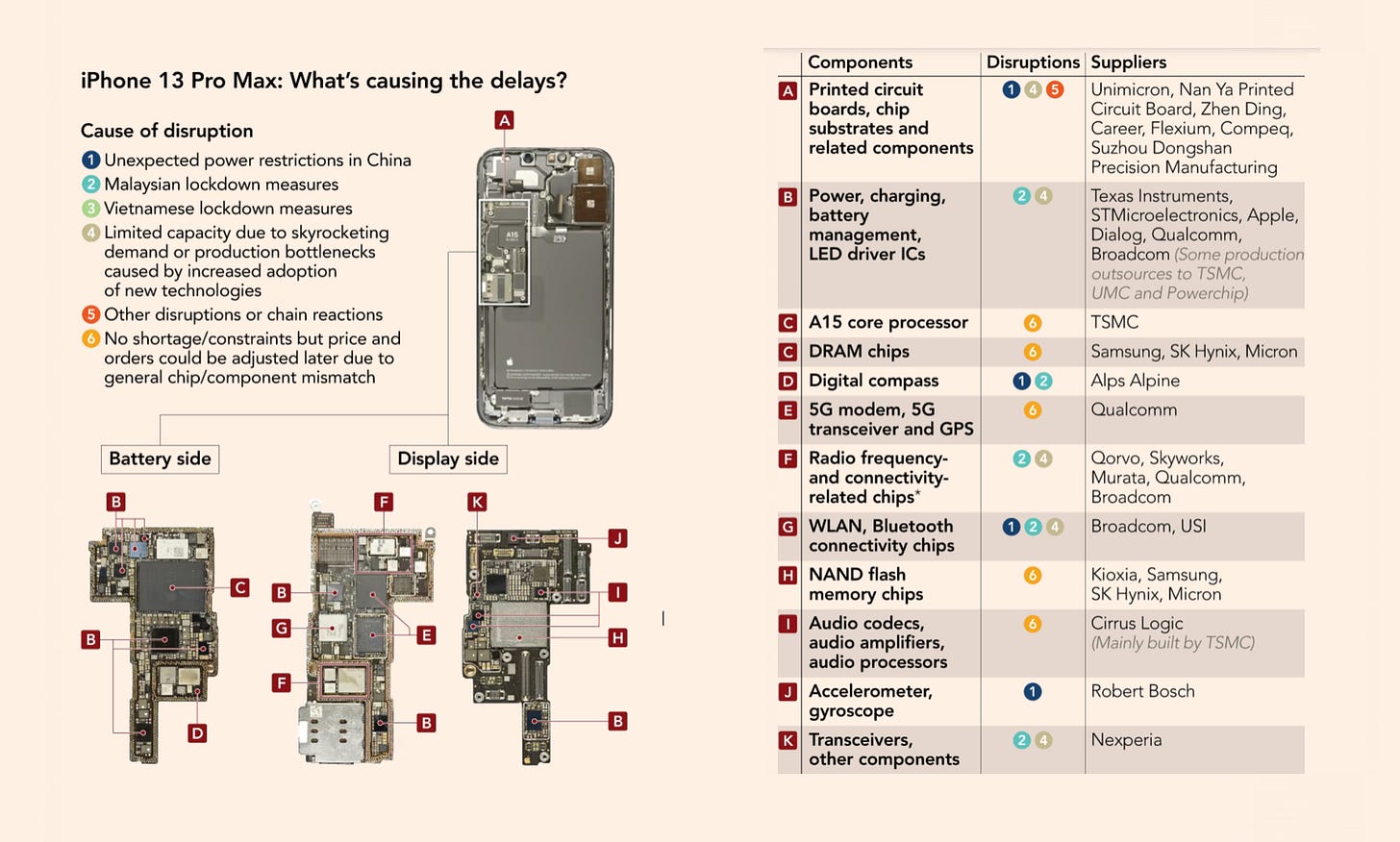

We see an analogous theme in consumer electronics. Below is an excerpt from a Financial times article illustrating iPhone 13 delays due to supply chain constraints.

Supply Chain Definitions

Below are some common terms you may hear when working with manufacturing and supply chain partners. Note that they’re biased towards automotive but generally apply across all industries.

Tier 1

Direct suppliers to an OEM/JDM/CM. They make complete systems or modules that can be plugged into an overall product.

For example - Seat suppliers for cars and camera suppliers for phones.

Tier 2

Provide components to tier 1s.

For example - Frame tube supplier for tier 1 seat supplier and lens supplier for tier 1 camera suppliers.

Tier 3

Suppliers that provide components or raw materials to tier 2s.

For example - Cold rolled steel for tier 2 frames and plastic manufacturer for lens suppliers.

ODMs (Original Design Manufacturer)

Designs and manufactures items which are sold under another company’s branding.

Ex: Honeywell making Amazon’s smart thermostat.

JDMs (Joint Design Manufacturer)

Hybrid approach where a company co-develops products with manufacturers.

Ex: TSMC for Nvidia.

OEM (Original Equipment Manufacturer)

Companies that may design or manufacture certain parts of their own.

Ex: Honda making its own engines and transmissions.

CM (Contract Manufacturer)

Provides services to completely manufacture a product. Usually the design has been completed by companies prior but CMs sometimes offer their design services as well.

Ex: Foxconn for Apple.

We’ll be focusing on contract manufacturers for this article. Don’t get caught up in definitions for now given that over the years I’ve found a lot of the terms above to be interchangeable.

The key is to have ownership over your product design, leverage supplier expertise for production, and ensure the manufacturing system is robust.

Low Cost Country Sourcing

Building products involves much more than just strategy, design, and engineering; it requires balancing

Technical feasibility

Business viability

User desirability

The last 2 can only be achieved by economical supply chain decisions. This is why hardware products are often sourced from low-cost regions.

It’s important to recognize that the equation isn’t as straightforward as “build for $50 and sell for $100”. Gross margins are comprised of various factors including assembly labor, packaging, BOMs, material attrition, shipping, and tarrifs. On top of this, fixed costs like non-recurring engineering (NRE), tooling, fixtures, certifications, and testing will significantly erode these margins. So much so that most hardware companies only achieve gross profit margins in Gen 2 of a new product and true net profit in gen 3.

While local production is always preferred, the factors above necessitate partnering with manufacturers abroad to achieve price points which users can buy. A great design is only valuable if users, who are price sensitive by nature, can buy it.

Supplier/Manufacturing Regions

When assessing the global landscape, we see the following regions with low cost, high value manufacturing partners: China, Vietnam, Thailand, India, Mexico, and Latin America.

Generally one should select these regions is if their product

Is higher volume ( typically > 5000 units)

Requires manual assembly and labor

Needs quick availability of machine bring up and repair personnel

Benefits from rapid development of manufacturing lines and tooling (molds, fixtures, and assembly equipment)

If your product is low volume, heavily automation dependent, or IP sensitive then consider local manufacturing partners.

For example, one of the reasons why automotive plants are local is due to the CapEX on robotic paint/weld lines and large import tariffs. Also consider aerospace plants being local as well due to lower volume, sensitive defense technologies.

Supplier Qualification Process

Now let’s talk about how to actually select a manufacturing partner. Below is a high level process flow.

As a general note, most of my content can be applied to the corporate, startup, or even entrepreneurial world. However for this post I’m going to give a disclaimer to any entrepreneur who’s ready to manufacture their first product.

Ensure you have several prototypes and have validated customer demand prior to engaging with manufacturers. Take the extra time to engage with users, get proof of concepts in people’s hands, observe their feedback, validate your assumptions, test corner cases, and review designs with experienced engineers.

The last thing you want to do is spend thousands in tooling and hours of your valuable time qualifying suppliers if your product will not sell.

Supplier Search & Assessment

Let's assume you’re in the PRD phase of the product development process. You have a design that has been prototyped and validated for customer demand.

When finding contract manufacturers, look for the following items to enable long term, sustainable relationships. A good tip is to talk to people or organizations who’ve used prospective suppliers before. Dig into the CM’s experiences and make sure they have the business and technical expertise in your product’s domain.

Product

Intellectual property protection

Capability and experience with similar products

Typical yields & build volumes

Product development process and timelines

Customer support & quality management systems

Typical tooling schedules and construction timelines

Logistics

Local and import taxes

Conversion rates

Accessible location

Preferred transport methods (truck, ship, air)

Lead times

Freight expenses

Raw material sourcing & availability

Regional

Local culture and norms

Government ties

Political infrastructure

Reliable access to workforce

Corporate Ethics

Sustainability practices

Social responsibility

Worker treatment

Regulatory compliance

Supplier Team

Talent and knowledge about subject matter

Management and ICs are aligned with vision

Company culture is friendly, honest

RFQs

The next step is to create RFQs. When doing this it’s important to balance sharing detail while not exposing critical IP. It’s okay to make a case for why your business is important, justify your positioning, and elaborate on product vision. After quotes are received, consolidate them and ensure the following items are accounted for.

Unit Costs - Used for COGs and gross margin calculations

BOM cost

Material cost such as part housing, PCBs, batteries, cameras, etc

Packaging

Shipping

Labor

Direct (higher rate): assembly, test, quality

Indirect (lower rate): packaging, repair

Tariffs

Material attrition

Repair costs

Fixed Costs - Go into LTV (life time value) calculations

NRE

Non recurring engineering - one time cost of new product development such as R&D, ME/EE/FW engineering, and manufacturing line design

Tooling

Molds or equipment used to produce parts - think injection molding for plastics and die casting for metals

Equipment

Fixtures, jigs, and manual or automated assembly machines

Certifications

Lab testing for regulation and safety compliance

Volumes

If low cost country sourcing then aim for at least 5000 units. Remember that most CMs only make tangible profits once volumes are in the tens of thousands

Supply Chain

Raw material availability

Product forecast and schedule

Tooling schedules

Equipment lead times and risk buys

Other

Legal terms

Quality management system

Certification process

Reliability testing process

Design for manufacturing/assembly process

FMEA/error proofing process

Cosmetic and Functional checks

General scrap rates

It’s critical to have multiple RFQs. Relying on one CM will almost always result in a disadvantageous situation for yourself. Don’t try to rush things by downplaying this step. Instead take your time to compare, negotiate, and finally select a suitable partner.

Factory Visits

One of the differentiators in hardware product development is the critical need to have hands on experience with what you’re building.

When I used to work in Japanese manufacturing we called this “Genba”, which means actual place. It’s not enough to rely on a picture or email, we have to be on the shop floor, especially considering how significant of an investment contract manufacturing is.

Apple took this so seriously that it was common for us to spend months in China. Everyone from new hires to directors and VPs were frequently traveling for engineering builds. This culture of obsessing over details in every aspect of product development may be one of the reasons why Apple’s products are so robust.

Once you’ve made a short list of suppliers, your teams should schedule factory visits to verify any assumptions. Here are some things to consider when auditing CMs.

Respect

This may seem obvious but over the years I’ve seen my fair share of execs scream at manufactures. And to nobodies surprise, that created friction when it came to solving real problems.

Yes suppliers will mess up. Yes they owe you high quality parts. But remember that it’s a long term partnership.

Suppliers are not at our mercy; they have other customers and production lines which have to meet certain build schedules.

Consider that many workers have cost of living/income ratios that are far different than yours. Suppliers need to charge a certain amount to maintain healthy business practices and wages.

They are the expert, not you.

Diligence

As an auditor you need to be objective, professional, articulate, and curious.

Ask several, concise questions and use diagrams. Don’t assume the obvious given foreign language constraints. Never be afraid to say “show me how this works”.

A good ratio is to be asking questions 20% of the time and observing/listening for the remaining 80%.

Have a clear, structured agenda.

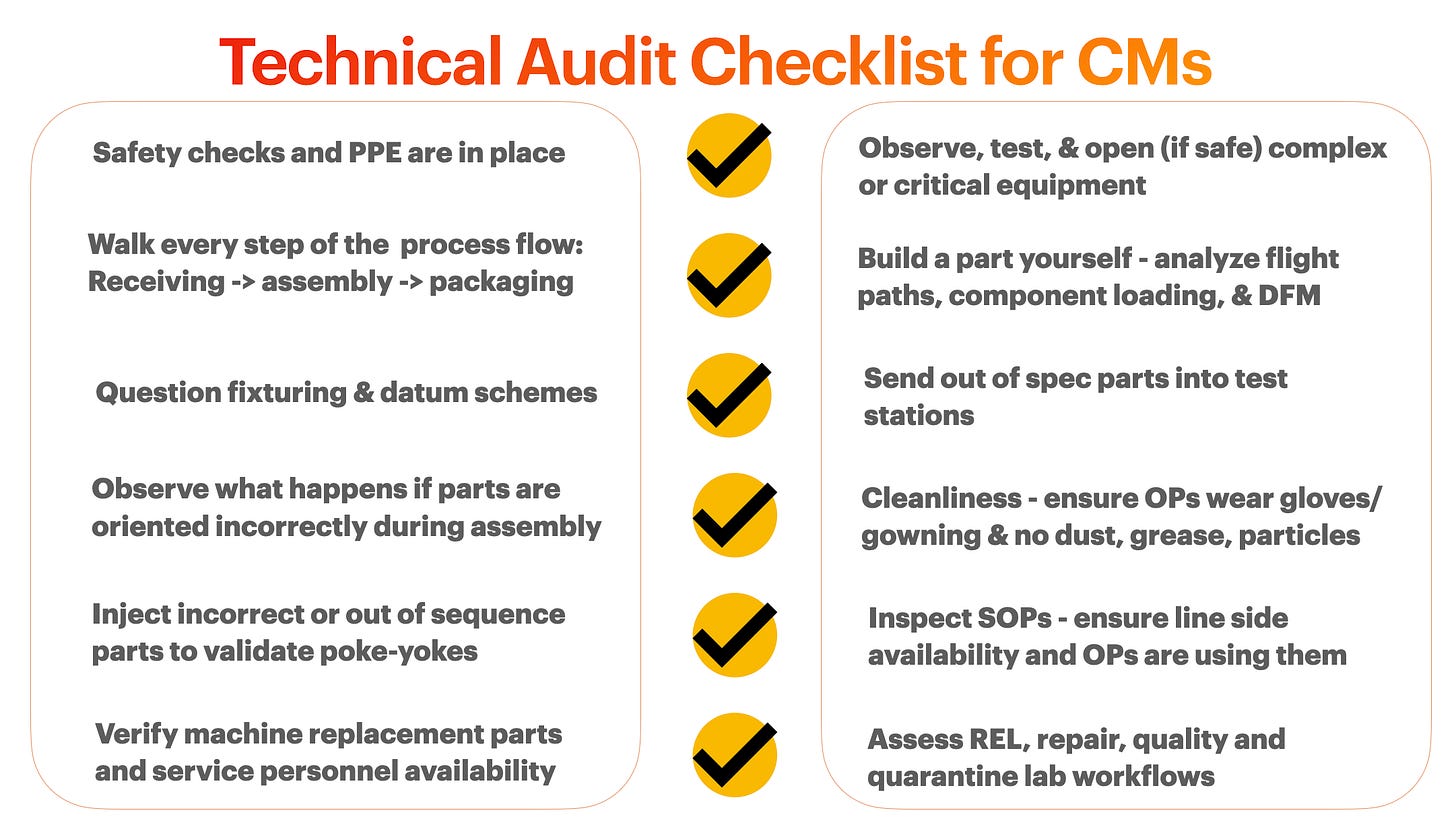

Technical Checklist

A lot of the design and manufacturing items below will only be feasible to audit after supplier selection but it’s good to have these questions in mind at all times, even when initially touring factories.

Selection & Development

Once a contract manufacturer is selected, it’s time to initiate a formal reporting process. Now’s the beginning of hopefully a mutually beneficial journey. It’ll require multiple check ins, meetings, visits, and validation work throughout your product development process. Below are some things to keep in mind.

Share BOMs, CAD, process flows, architectures, schematics, & FMEAs

Set clear responsibilities for all teams on both sides

Legal, product, engineering, design, quality, and supply chain.

Get all teams involved early and often. As mentioned above, the incremental cost to product development of changes later in the process is significant.

Have a strict and meticulous issues list

Use this to track all product development issues, responsibilities, and timing for closure. Review it weekly at minimum with your CM.

Develop a supplier scorecard

Rate your CM on quality, delivery, and safety targets while giving them consistent feedback on performance. This will be handy when it comes to re-assessing contracts.

Create templates

After years of working with Asian suppliers and manufacturers one trick to save you hours and free up your evenings is to make simple templates. You should drive reporting, not the CM. Dont be afraid to ask for details.

Make diagrams of what you want them to show you (parts, setups, fixtures, testing, etc)

Create clear, objective tables for DOE requests (design of experiments)

Develop a format for yield, quality, schedule, and test reports

Develop a format for FA reports (failure analysis, root cause studies, etc)

Have boots on the ground

It’s critical to be line side, especially during engineering builds. No amount of phone or video calls will do justice. If travel is difficult then consider having an in region team - a local representative who can audit the factory on your behalf.

As we finish this article, it’s clear that supplier qualification and development is a very nuanced process. It may seem overwhelming but working with contract manufacturers to go from prototype phase to mass production launch is extremely rewarding.

In the next few weeks to months I’ll be writing more about manufacturing specifics like designing a production line, ramping, and FMEAs. For now I hope this was a good intro.

Thanks for Reading

Make sure you check out some other articles:

If you enjoyed this, like and spread the word. If you have any questions on hardware PMing, product development, or careers let’s talk.